People are naturally apprehended by issues that are unpredictable, much more so, if this kind of can wreak havoc to their physical bodies and investments. This kind of risks to lives and attributes have merited the attention of many scientists, who have place forth fantastic amounts of time and power attempting to manipulate and predict dangers. That risks continue to be unscheduled to this day is somewhat a testament that it continues to be an exercise in vain.

Maybe, not entirely, because their efforts have led other sectors and branches of self-discipline to, at the extremely minimum, relieve the extreme losses suffered by those that fall into a danger. The financial business, for instance, have created techniques of danger administration. On a person degree, cost savings account may be opened for individuals to prepare for risks and other emergencies. On the company level, risks may be shared among members of the group.

Hence, the concept of insurance coverage is born into people?s consciousness. Now, The individual having to pay this cost?the insured?has discovered a way to be protected from the price of damaging risks, by simply anticipating them and paying for your cost small by small. Obviously, the insurance provider?or, insurer?also takes dangers in the transaction, in the price with the danger might be higher, especially if it occurs shortly following enforcing the insurance coverage policy.

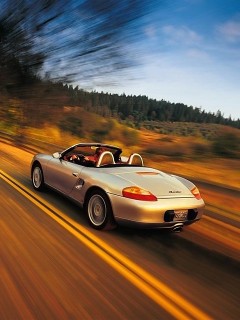

Of the insurance coverage kinds available today, car insurance, particularly the 3rd Party protection, is maybe most typical and frequently legally mandated by many governing bodies. The prevalence of car use as a mode of transportation is a powerful situation for obligating drivers to procure one. Aside from this, people around the wheels have to consider under consideration other relationships in addition to with their own automobile and passengers. There are other drivers and passengers on the street, pedestrians, and properties belonging to personal people and the authorities.

Some drivers will include other types of instant auto insurance besides their existing public insurance coverage policies. 1 that's frequently neglected and overlooked is the Underinsured or Uninsured Motorists (UM/UIM) coverage. This really is rather essential in the event of an accident wherein the party at fault is not covered by any kind of insurance, or is covered insufficiently. With UIM protection, the insurer pays for the hospital bills with the insured and liaisons with the driver?or his insurance provider?faulted for the incident.

Smarter driver often go for full protection to be hedged from losses incurred as a result of risks, described as ?functions of God?, such as serious weather circumstances. Other damages consequently of fire, theft, or animal attacks will also be covered beneath such car insurance. Full protection is a mixture of Comprehensive and Collision protection, each of that are deductibles, compensated outside of the premium. Driver who desires to pay a decrease top quality often select to just spend these deductibles out-of-the-pocket.

No comments:

Post a Comment